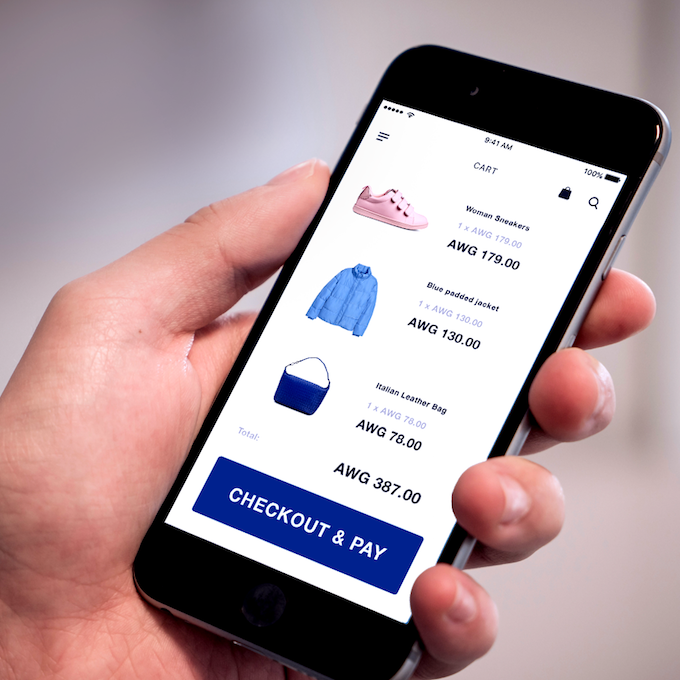

eCommerce Solution

Start receiving payments from your eCommerce store to your Aruba Bank account.

Our new eCommerce solution in partnership with CX Pay will allow you to easily create and maintain your online store, and more importantly, allows you to receive funds from your eCommerce store straight into your Aruba Bank account.

Benefits

-

Right for you if you want

-

Fees and charges

-

What you need to apply

Aruba Bank’s eCommerce solution is right for you whether you’re in the launch stages of establishing an eCommerce site, or are already operating an online store and are interested in expanding your business by selling products and services to customers all over the world.

Benefits:

Fees that are charged by CX Pay (depending on the technical (type of integration) setup best suited for your business):

The pricing provided below, is for volume UP to US$ 100K (Debit / Credit Cards) in a particular month.

For the months it is over, an adapted price will be applied.

Debit and Credit Cards (Visa / Mastercard/Discover/AmEx):

Gateway Account Activation fee (1-time): US$ 50

Technology Setup fee:

Monthly: US$ 16

Per transaction: US$ 0.28

Commission on Monthly incoming funds: 0.25%

A $158 (includes Transaction fee) security deposit will be required for CX Pay to begin with the Gateway Account activation.

For questions regarding fees please contact CX Pay on accounts@cxpay.global

Fees and charges may be amended at any time at CX Pay’s sole discretion.

The Aruba Bank eCommerce solution is ideal for startup or small businesses that want to be able to sell their products and services online.